32% of Russians Have to Pay off Their Loans or Mortgages

The survey identified, how Russians define their income, what they borrow for from the banks, and what % of their income they use to pay off their loans or mortgages

According to the survey, 29% of Russians define their income as average, 58% of the respondents define their income as below average, while 9% of the respondents think their income is average+. 4% of the respondents found it difficult to answer.

Today 32% of Russians have to pay off their loans or mortgages. 63% of them pay off consumer loans, while 37% — mortgages.

Loans and mortgages are most often used by Russians with a below average income — 36%. People with an average+ income use loans least often - 26%. At the same time Russians with a low income most often use consumer loans (68%), while people with a high income — mortgages (54%).

29% of the respondents with an average income have borrowed money from the banks. Today 47% of them pay off their mortgages and 53% - consumer loans.

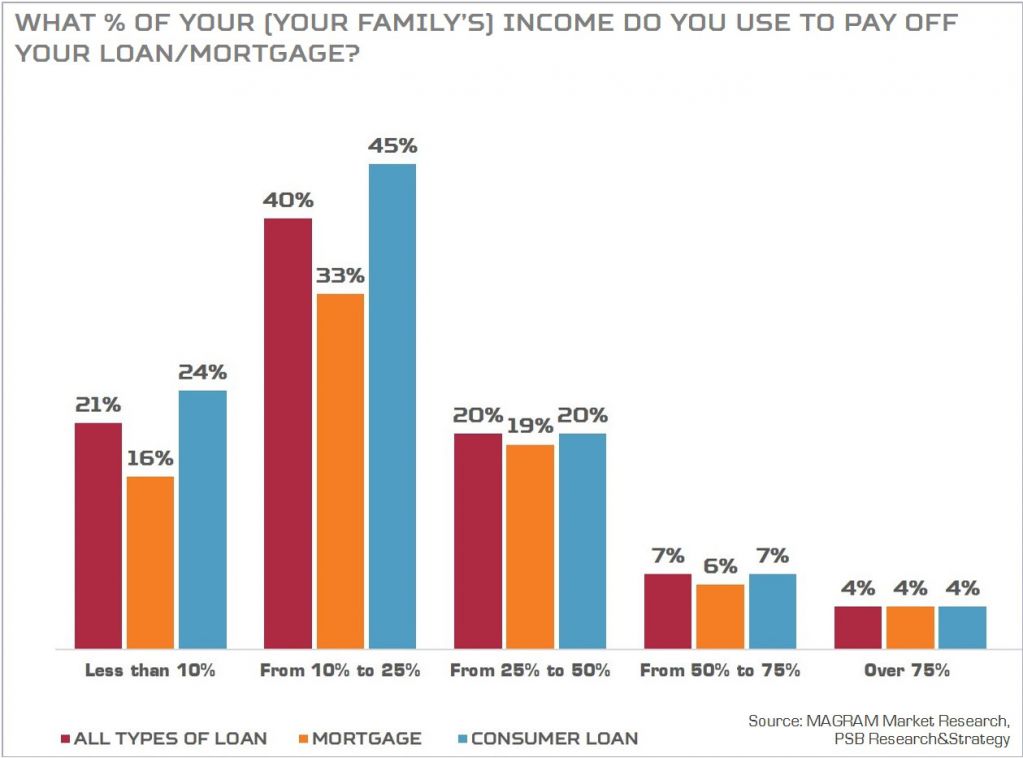

Pay off amount

In the average the borrowers use 26% of their income to pay off their loans. At the same time the amounts of paying off in case of mortgage and consumer loan are about the same — 27% and 25% of the income accordingly.

Consumer loans

Consumer loans are normally used for the following purposes:

• flat/dacha/cottage renovation – 32%

• buying a new car – 25%

• buying major domestic appliances/electronics – 18% (mainly people of 25-34 y. o. (24%)

• everyday needs – 13%

• paying off another loan – 9% (recrediting is most often used by people of 35–44 y. o. – 15%)

• medical treatment – 7%

• vacation/wedding – 5% (this type of loans is most popular among people of 18-24 y. o. – 15%)

• 1% of the respondents use loans to develop their own business and for training both their own and their children’s or grandchildren’s.

Geography

The most credited federal districts are Siberia and Ural, the shares of their residents, who have to pay off their loans and mortgages make 43% and 38% accordingly (note, that this indicator makes 32% countrywide).

The citizens of the Center vice versa use bank loans less often — only 27% of them have this or that loan. At the same time the Center is the region with the maximum mortgages — 44% vs 37% countrywide.

The biggest number of consumer loans is used in the Volga district — 70% of consumer loans vs. 30% of mortgages. At the same time the total share of borrowers is almost the same as the countrywide average.

Additionally

The most active borrowers are Russians in the age of 25 - 44 y. o. — today they pay off 47% of all loans: 26% – 25–34 y. o., 21% – 35–44 y. o.

At the same time young people are the main users of mortgage products:

• 25–34 y. o. – 38% and

• 35–44 y. o. – 25%.

In the age group of 65 y. o. the share of borrowers is decreasing rapidly: only 8% of all loans belong to Russians of 65+.

It should be highlighted, that the older generation tend to use consumer loans more often. ¾ of borrowers over 45 y. o. use consumer loans:

• 45–54 y. o. – 75%

• 55–64 y. o. – 83%

• 65+ y. o. – 79%.

The research was made in December 2018 in all federal districts of Russia. The survey covered 4,250 respondents 18+. The sample represents the population of the Russian Federation.